We collect basic website visitor information on this website and store it in cookies. We also utilize Google Analytics to track page view information to assist us in improving our website.

Every Donation Makes a Difference

Our hospital relies on community donations to purchase new and replacement medical equipment and technology that keeps us on the leading edge of care. Donations are also used for facility upgrades and special projects. Your support today will help us to continue to deliver exceptional care, close to home, both now and for future generations.

One-time donations may be made by cash, cheque, credit card, money order, gifts of securities or e-transfer*.

*Please enter the following email address in the ‘To’ field of the e-transfer form on your online banking account: [email protected]. In the message field please include “Donation”, along with your mailing address and phone number so that we may issue a tax receipt. This information can also be sent via email.

Cheques can be mailed to our office.

Cheque/credit card/cash donations can be made by visiting us during office hours.

Credit card donations can be made by calling our office at 519-272-8210 ext. 2626

Make a Lasting Impact

By becoming a Circle of Care Monthly Donor, you provide steady, reliable support to the Huron Perth Healthcare Alliance – Stratford General Hospital. Your monthly gift helps ensure that we can continue making a lasting impact on the health and well-being of our community.

Monthly giving is an easy and convenient way to create meaningful change. Your recurring donation, no matter the size, adds up over time—allowing the Foundation to invest in essential equipment, plan for future needs, and enhance patient care in ways that truly matter.

As part of the Circle of Care, you’ll join a dedicated community of supporters who provide the strong foundation we rely on to deliver exceptional healthcare.

You can adjust or cancel your monthly gift at any time.

Celebrating Life's Milestones

In-honour gifts provide a unique way to celebrate significant moments in the lives of those you care about. Whether it’s a birthday, anniversary, retirement, or another special occasion, making a gift in someone’s honour is a heartfelt tribute that extends beyond the moment. These donations can be a meaningful alternative to traditional gifts, symbolizing the spirit of generosity and care that the honoree embodies.

By supporting the Huron Perth Healthcare Alliance - Stratford General Hospital, you not only celebrate their achievements and milestones, but you also help guarantee the highest quality of care, close to home, both now and for future generations.

Consider honoring a loved one’s next big celebration with a gift that has a lasting and profound effect.

At your request, we’ll ensure your thoughtful gesture is shared with the honouree. Please enter the address or email when making your donation.

Memorial Gifts are a wonderful way to acknowledge the memory of a loved one or friend.

Many employers match the donation contributed by their staff. We encourage you to contact your employer to find out if your company has a matching gift program. Contact the Foundation for assistance.

Call us if you’d like to establish a payroll deduction program at your place of work. Smaller, more frequent donations through payroll can add up over time with minimal discomfort.

Gifts-in-Kind are non-cash gifts such as securities, real estate, and tangible property such as equipment. They are evaluated and appraised in order to confirm their current value for income tax receipt purposes.

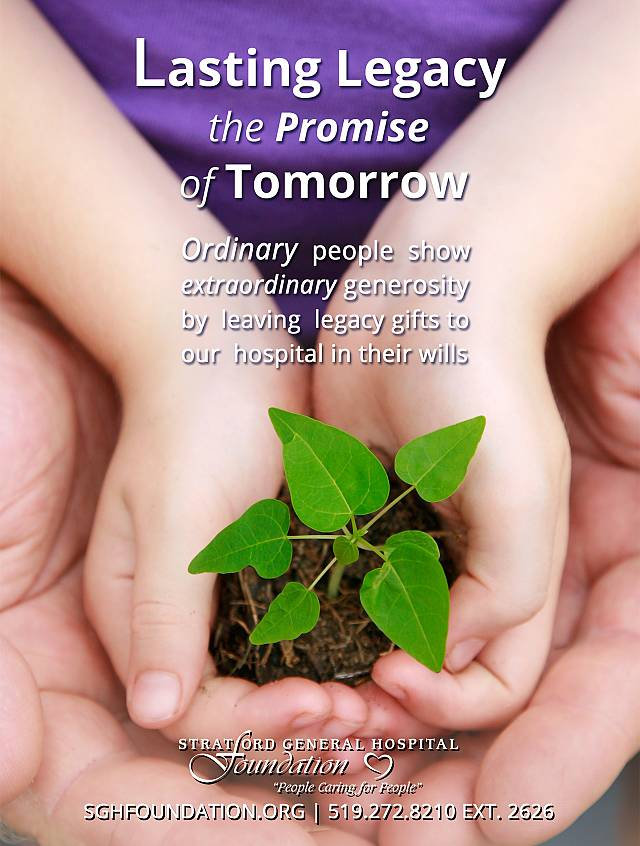

Planned Gifts are becoming an increasingly popular way to leave a lasting gift. Bequests made through your will, and special gifts by other methods such as life insurance or charitable trusts will help patients for years to come. With the assistance of your own financial advisor and the Foundation, your gift can be structured to help you support our hospital without jeopardizing your current needs.

Donate stocks, bonds, and mutual funds, and take advantages of tax benefits.

When you make a gift of securities to the Stratford General Hospital Foundation you are investing in high quality care, close to home, both now and for future generations. By donating publicly traded securities, you save on taxes on the capital gains. You’ll also receive a charitable tax receipt for your donation.

Securities can include stocks, mutual funds, segregated funds, bonds, flow-through shares, and employee stock options.

You can give now, or as part of your estate and will planning.

Giving is simple:

Consult your financial advisor to decide which invesments make the most financial and philanthropic impact.

Complete our transfer form and instruct your broker to transfer your securities directly to the Stratford General Hosptial Foundation.

Each donation is precious to us, and every donor is priceless. Besides that warm feeling in your heart you get from supporting our hospital, we have a variety of options available to ensure your generosity is recognized if that is your wish.

Please note that all online donations are made through Giftool, which is completely secure.